$2.5bn projects and deals since 2005

Real estate

capital markets

platform

$2.5bn projects and deals since 2005

$2.5bn projects and deals since 2005

Real estate

capital markets

platform

Real estate

capital markets

platform

PLATFORM

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

Over 20 years, we have executed more than 50 transactions and attracted $2.5bn of investments in Russia, Europe, and Middle East.

PLATFORM

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

Over 20 years, we have executed more than 50 transactions and attracted $2.5bn of investments in Russia, Europe, and Middle East.

PLATFORM

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

"We have created a real estate financing platform for professional participants on the global markets based on over 20 years of experience and best institutional practices."

Dmitry Eremin, CFA

Managing partner

"In a changing economic environment, we find effective solutions for owners, investors, developers, and banks that allow new landmark projects to come to light."

Mikhail Getz

Partner

"The comprehensive expertise and experience of our team allow us to carry out the most complex transactions. Our goal is to create exclusive investment opportunities."

Artyom Korsovskiy

Partner

Over 20 years, we have executed more than 50 transactions and attracted $2.5bn of investments in Russia, Europe, and Middle East.

solutions

01

Purchase and sale of assets

We offer land and real estate owners a comprehensive approach that allows fully unlocking the asset's potential and implementing the best sales strategy among investors.

02

Joint ventures

We attract equity capital and create partnerships to implement development projects. Our experience in joint ventures includes various markets and geographies, including Russia, Europe, and Middle East.

03

Credit financing

We attract debt financing from banks and private lenders, optimize the structure and cost of financing for development companies, real estate funds, and corporate clients.

01

Purchase and sale of assets

We offer land and real estate owners a comprehensive approach that allows fully unlocking the asset's potential and implementing the best sales strategy among investors.

02

Joint ventures

We attract equity capital and create partnerships to implement development projects. Our experience in joint ventures includes various markets and geographies, including Russia, Europe, and Middle East.

03

Credit financing

We attract debt financing from banks and private lenders, optimize the structure and cost of financing for development companies, real estate funds, and corporate clients.

01

Purchase and sale of assets

We offer land and real estate owners a comprehensive approach that allows fully unlocking the asset's potential and implementing the best sales strategy among investors.

02

Joint ventures

We attract equity capital and create partnerships to implement development projects. Our experience in joint ventures includes various markets and geographies, including Russia, Europe, and Middle East.

03

Credit financing

We attract debt financing from banks and private lenders, optimize the structure and cost of financing for development companies, real estate funds, and corporate clients.

Services

We have gathered all the necessary competencies and infrastructure to execute transactions on a single platform.

Our work on the deal consists of several stages during which we utilize the various functional expertise of team members.

Our work on the deal consists of several stages during which we utilize the various functional expertise of team members.

Cases

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Cases

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Cases

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

Sale of land plot

Terms

Land plot – 5.0 ha on the west of Moscow

Operating industrial enterprise, relocating the business outside of the MKAD

Title – ownership on the balance of a legal entity

Presence of non-core assets on the balance of a legal entity

Owner – individual, business owner

Residential construction possible after changing the land use category

Task

Find a buyer, agree on terms between the parties, and conclude the deal

Solution

Analysis of title documentation and urban development potential

Financial model of the project and valuation of the land plot

Preparation of the investment proposal

Investment marketing for a closed circle of developers

Agreement on the commercial terms of the deal

Conducting due diligence of the land plot and project company

Structuring the deal for the transfer of title and calculations

Result

An effective structure was formed, carried out through the sale of shares in the project company

01

"The deal was executed in the shortest possible time and became a landmark for the developer."

Mikhail Getz

Partner

Creation of a joint venture

Conditions

Land plot – 0.6 ha in the center of Moscow

Availability of counter obligations of the owner of the land plot

Project – construction of a business class residential complex

Owner of the land plot – private individual

Participation of the owner, developer, and financial investor in the deal

Task

Attract funding and form a partnership for project implementation

Solution

Analysis of the economic potential of the project, identification of risk factors

Due diligence of the land plot and project company

Development of a joint venture project

Agreement on terms between the owner, developer, and financial investor

Formation of management mechanisms for the joint venture

Development of protection mechanisms through option terms for partner buyouts

Agreement on commercial terms for project implementation

Determination of the conditions for the developer's bonus reward

Result

Signing of the deal and financing through additional capital issuance

02

"The partnership agreement has made it possible to implement the project while maintaining a balance of interests among all parties to the deal."

Dmitry Eremin

Managing partner

Loan for asset purchase

Terms

Business center in the center of Moscow

Presence of an outstanding bank loan on the property

Acquisition deal involving financing from the bank

Attracting additional capital for financing the deal

Buyer – private individual, owner of a group of companies

Task

Attract loan financing and carry out the transaction for purchasing the asset

Solution

Asset assessment and preparation of a financial model for creditors

Formation of the deal structure involving senior and mezzanine creditors

Preparation of an investment proposal and selection of the best terms from banks

Negotiation of mezzanine loan terms

Structuring financing from shareholders

Conducting due diligence on the property

Negotiation of transaction terms with the current creditor of the property

Signing transactions for attracting senior and mezzanine debt

Result

Financing structured with the involvement of two creditors, a deal has been made with the attraction of loan capital

03

"The deal structure allowed for the transaction to be executed with minimal equity, which became a source of additional return."

Artyom Korsovskiy

Partner

featured transactions

Over 20 years, we have executed more than 50 transactions and attracted $2.5bn of investments in Russia, Europe, and Middle East.

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

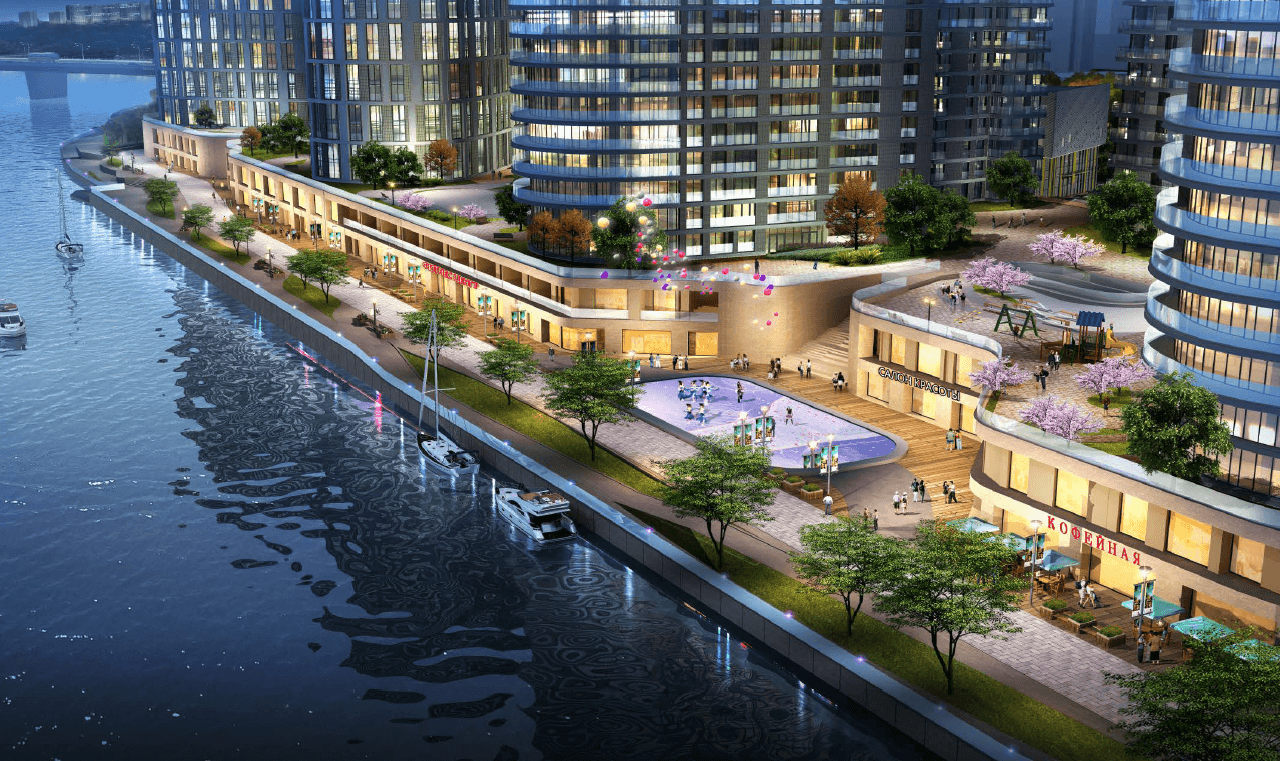

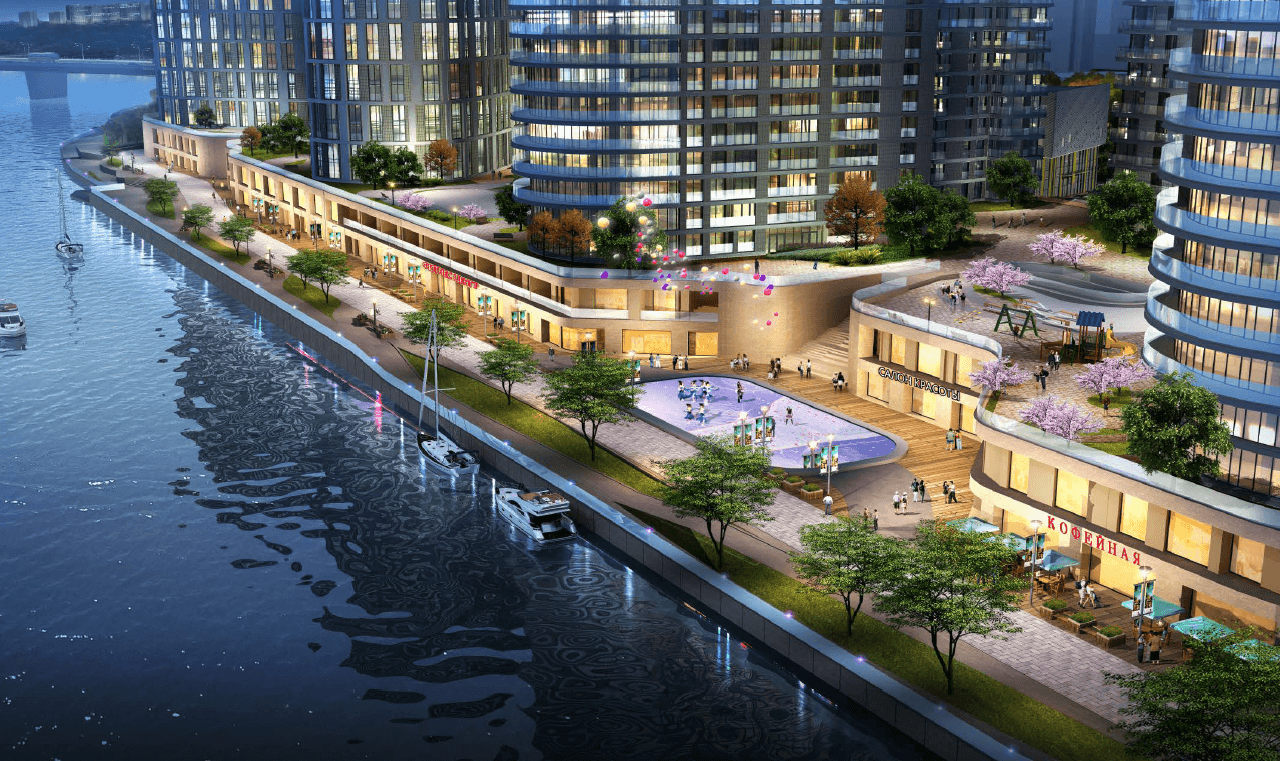

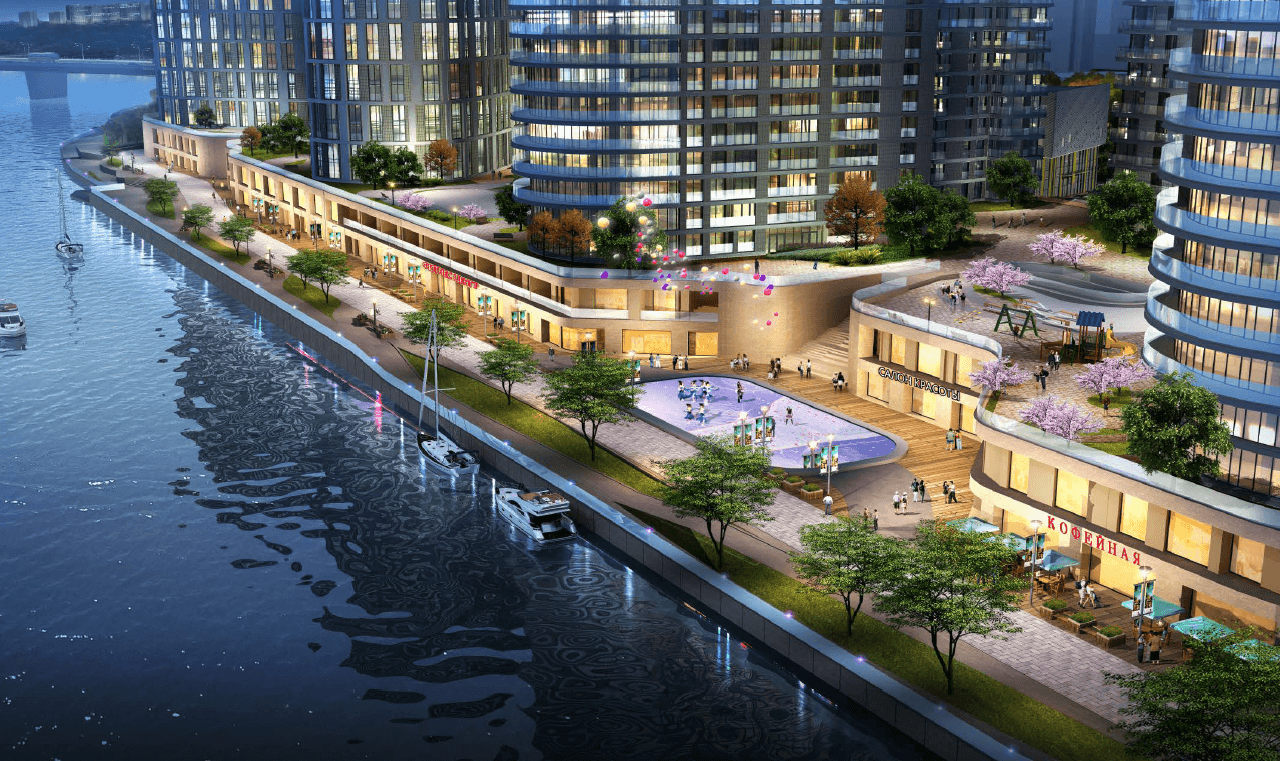

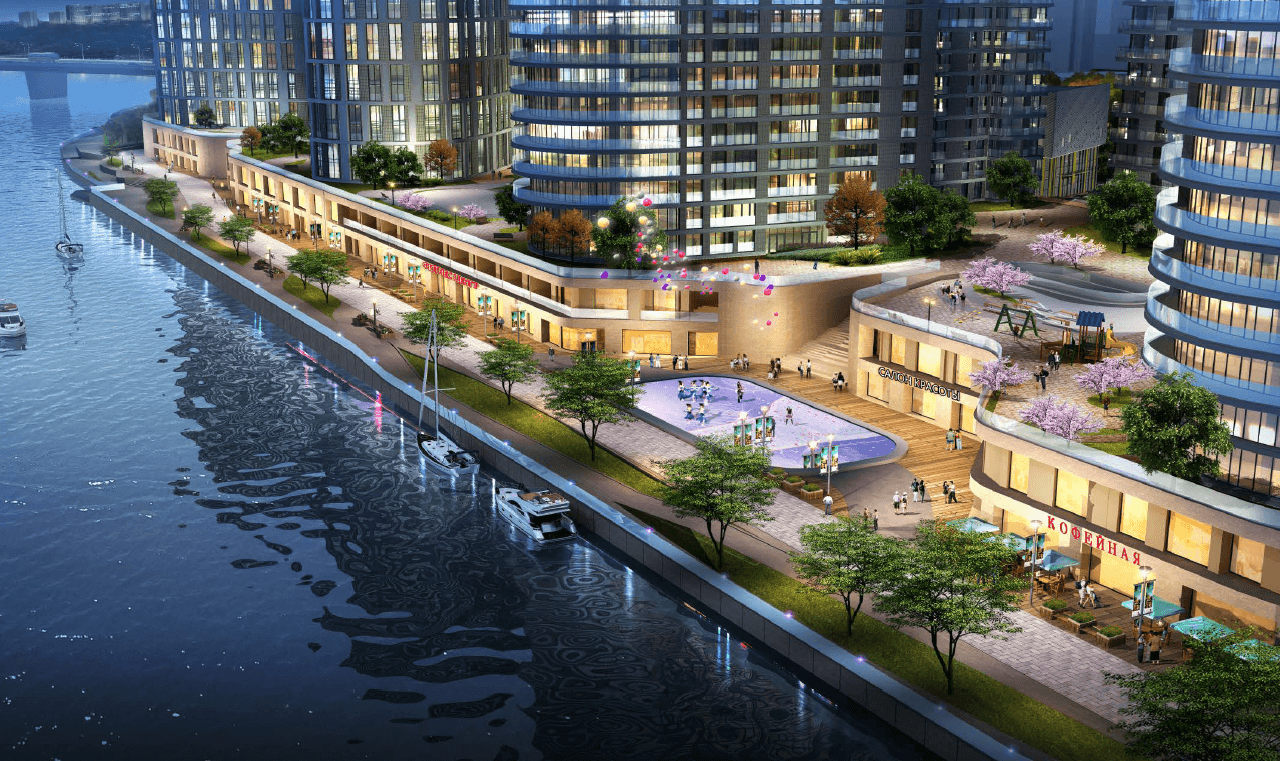

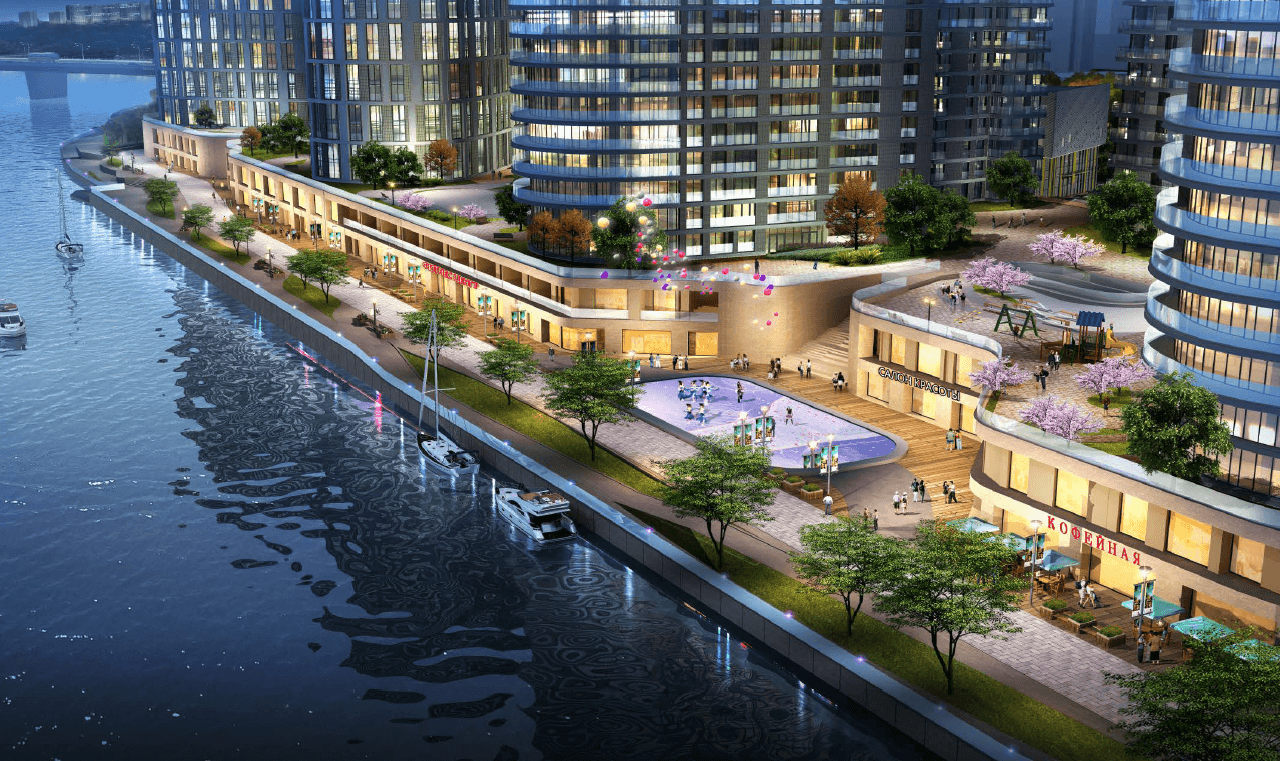

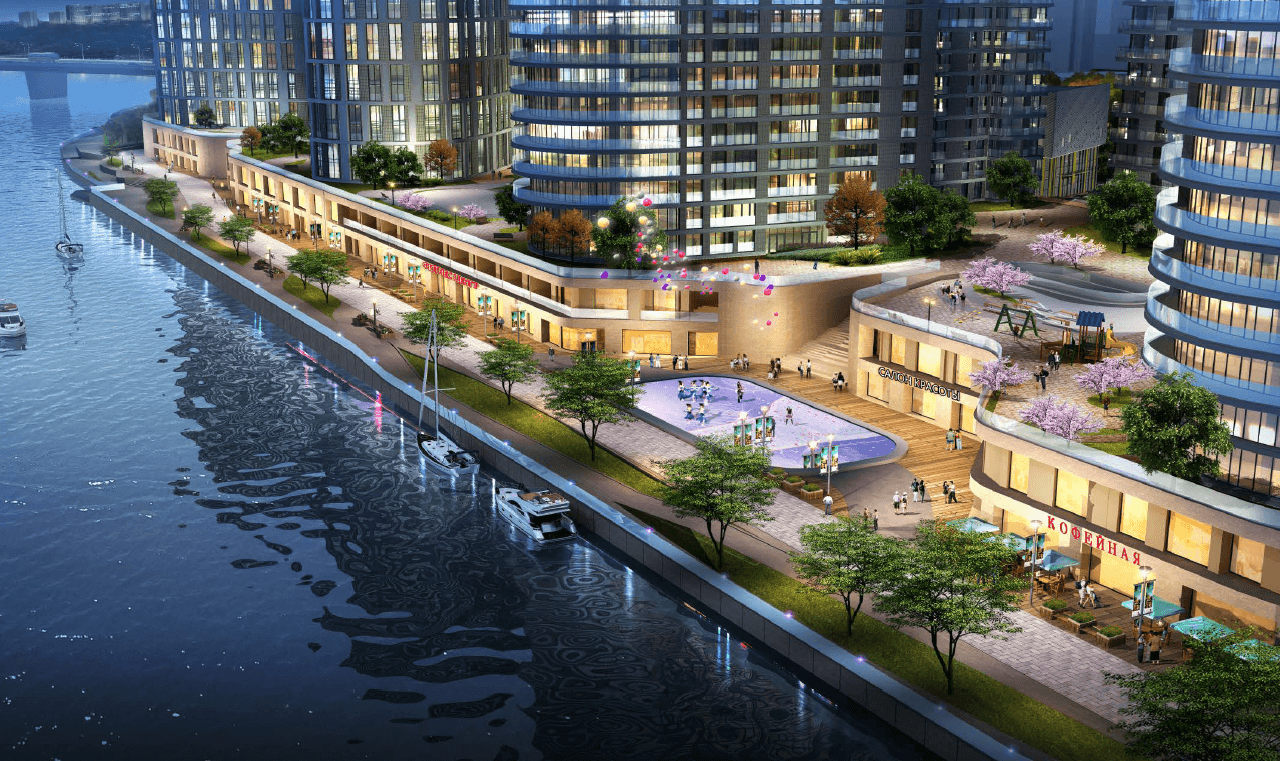

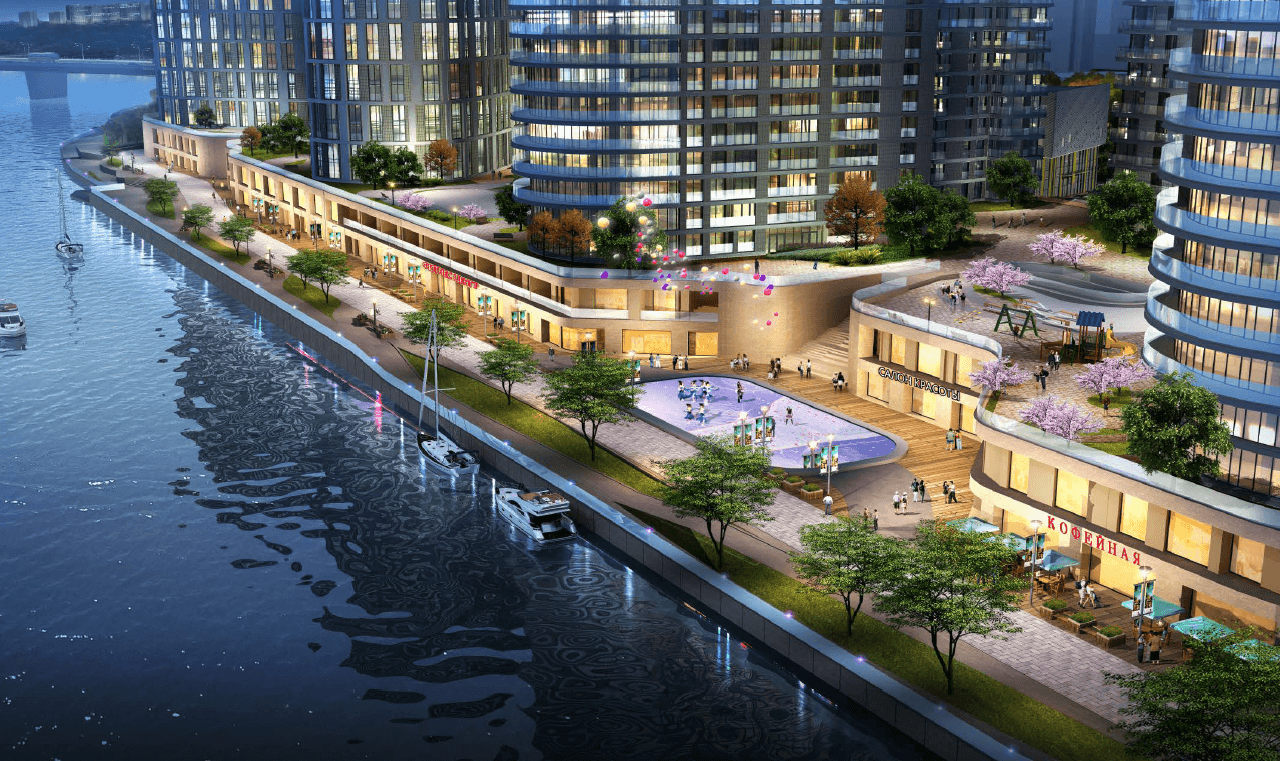

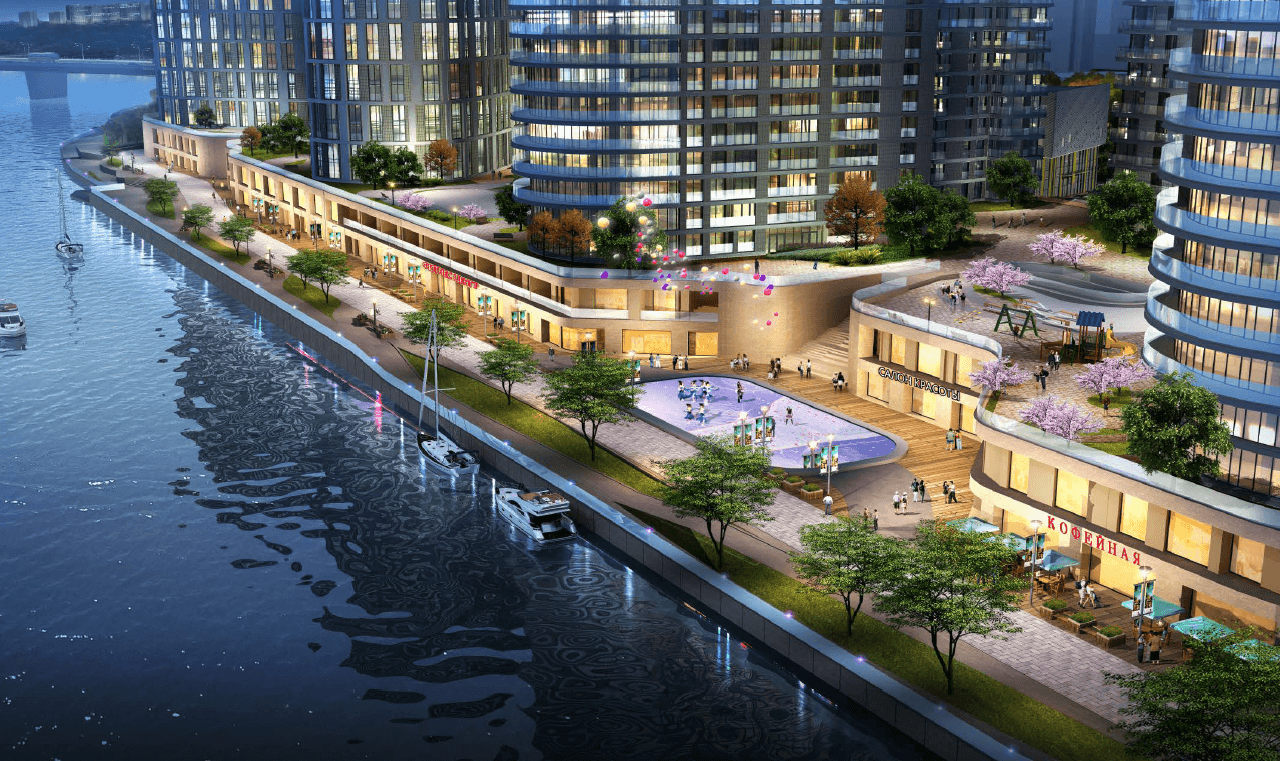

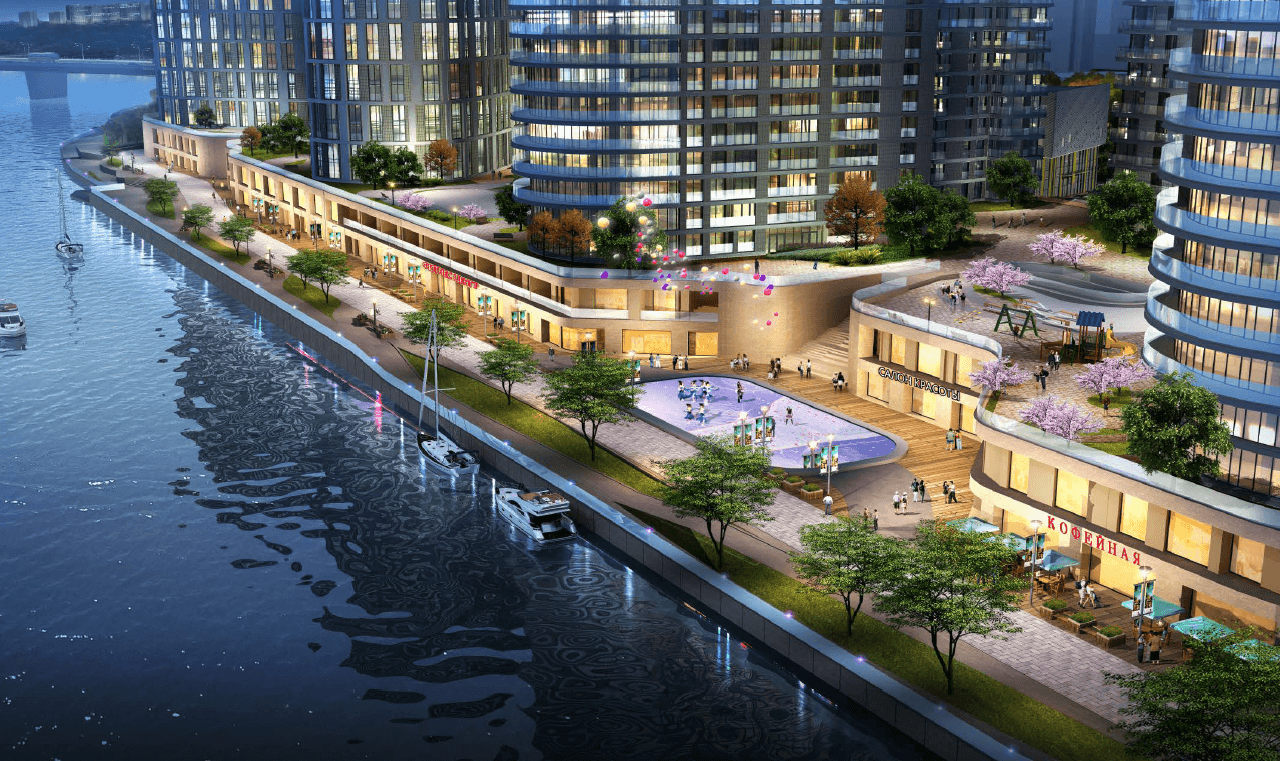

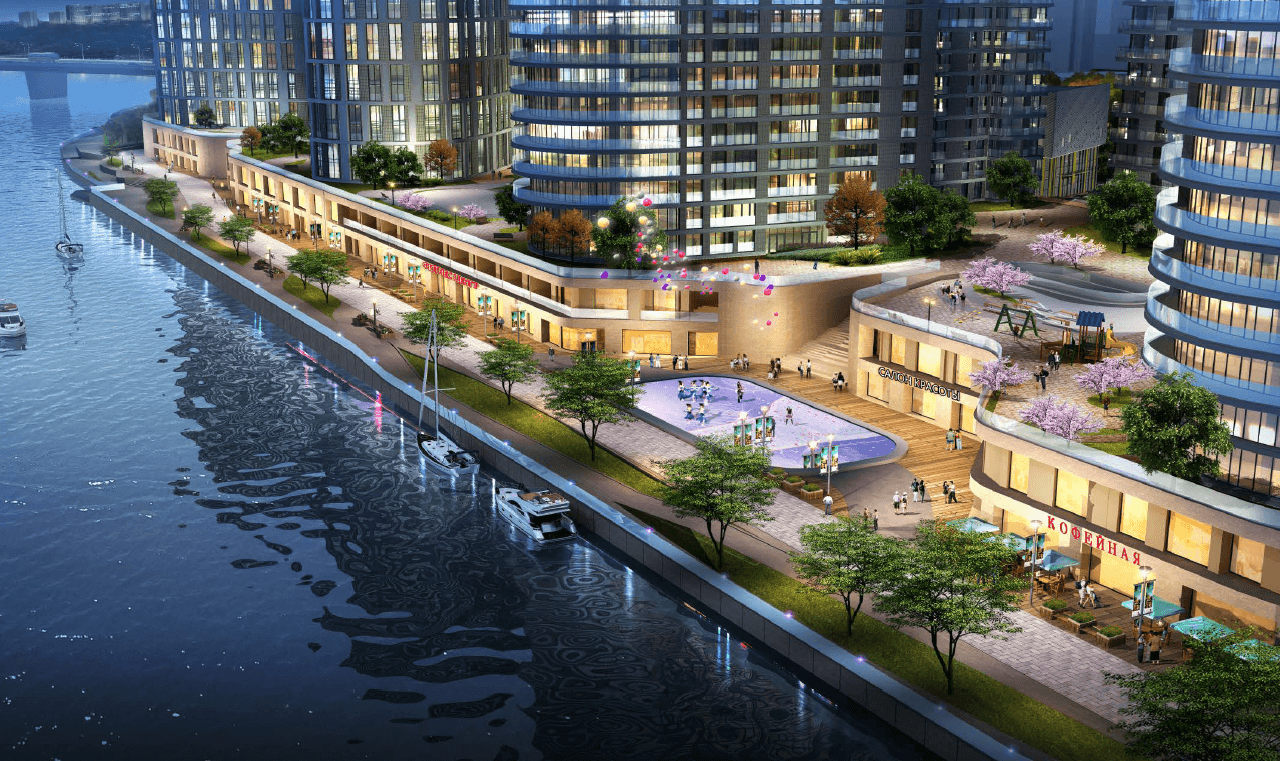

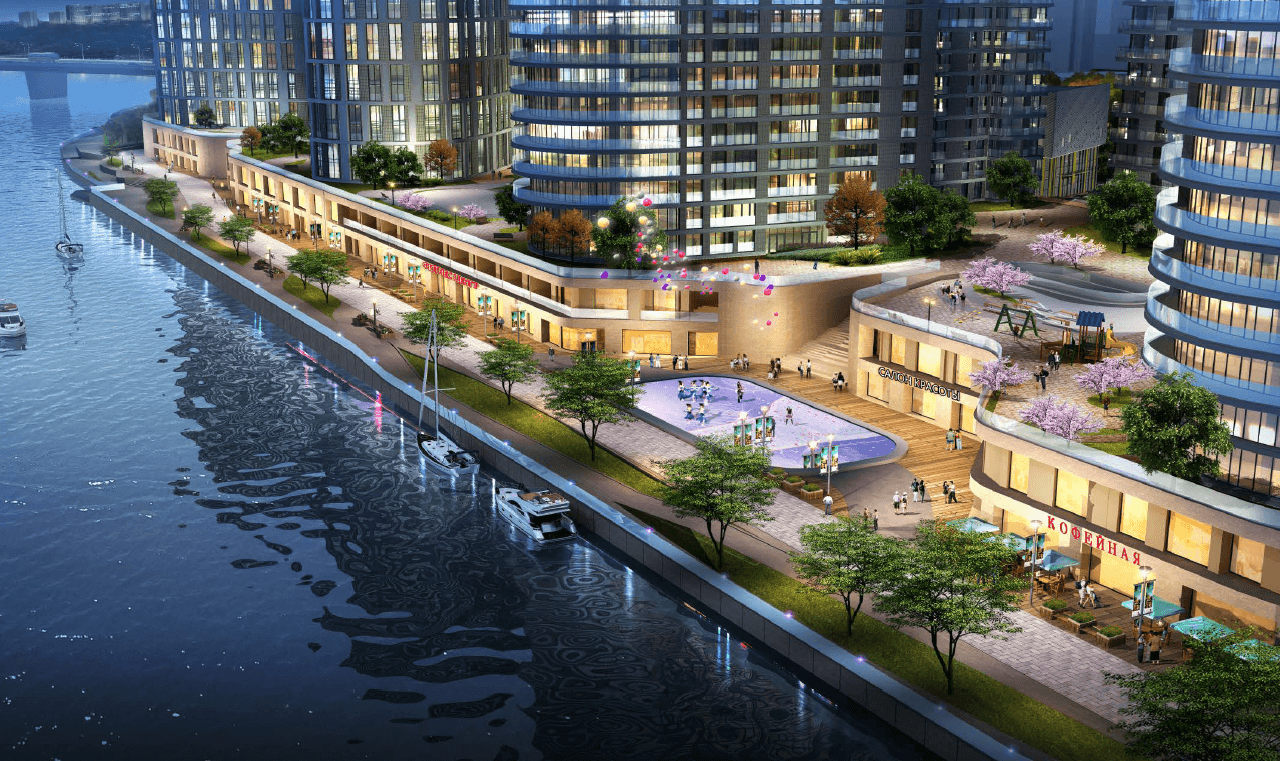

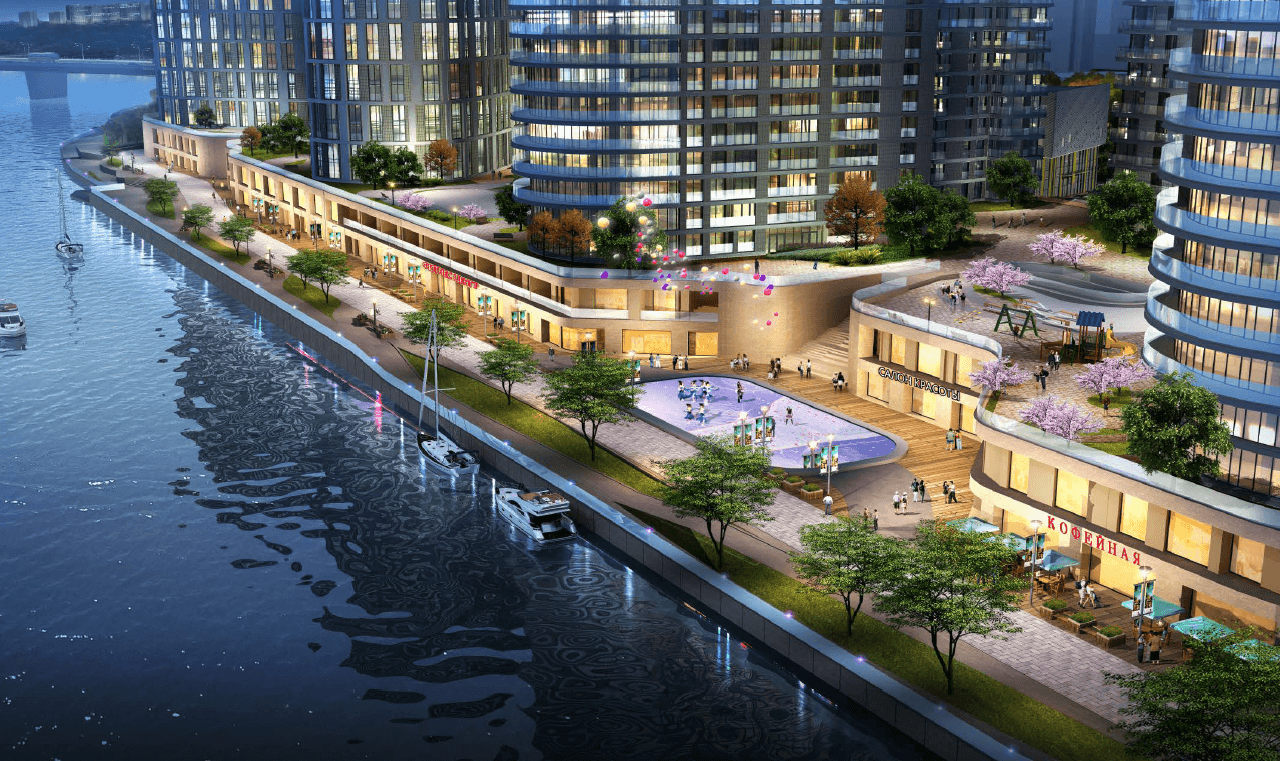

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

2013

Project financing

Sberbank

75,000 m2

Class A business center

k2 business park

2015

Purchase of the land plot

Private owner

180,000 m2

Residential complex

aquatoria

2016

Contract with the operator

Marriott, Bulgari

19,600 m2

Hotel on Nikitskaya

Bulgari Hotel & Residences Moscow

2016

Joint venture

Ant Yapi

17,300 m2

Residential complex in Fili

Fili Park

2017

Acquisition of the project

Investment group

98,800 m2

Apartments on Kutuzovsky

Poklonnaya 9

2017

Joint venture

Capital Group

36,900 m²

Apartments on Belorussky

Soho & Noho

2018

Acquisition of the project

Investment group

79,800 m2

Premium residential complex

Victory Park

2021

Mezzanine financing

Investment bank

35,000 m2

Class B Business Center

Novo Suschevsky

2022

Sale-Leaseback

Transfin-M

5,000 m2

Class B Business Center

Meliora Place

Partners

Our partners are the largest Investors, developers, Banks, and property owners

Feedback form

Order a callback

Carte Capital

info@cartecap.com

Carte Asset Management

203 King Salman Bin Abdulaziz Al Saud, Arjaan Office Tower, Dubai

info@carte.ae

F9 Capital Management Ltd.

Suite 202, 14th Floor, Al Sarab Tower, ADGM Square, Al Maryah Island, Abu Dhabi

Authorised and regulated by FSRA (Permit No: 220091)

hello@f9capital.ae

Copyright © Carte 2024. All rights reserved.

Carte Capital

101000, Moscow, Russia

info@cartecap.com

Carte Asset Management

203, King Salman Bin

Abdulaziz Al Saud Street

Al Sufouh 2, Dubai, UAE

info@carte.ae

F9 Capital Management Ltd.

Suite 202, 14th Floor

Al Sarab Tower, ADGM Square

Al Maryah Island, Abu Dhabi

Authorised and regulated by FSRA

(Permit No: 220091)

hello@f9capital.ae

Copyright © Carte 2024. All rights reserved.